Auto Glass Billing Software Challenges and How to Overcome Them

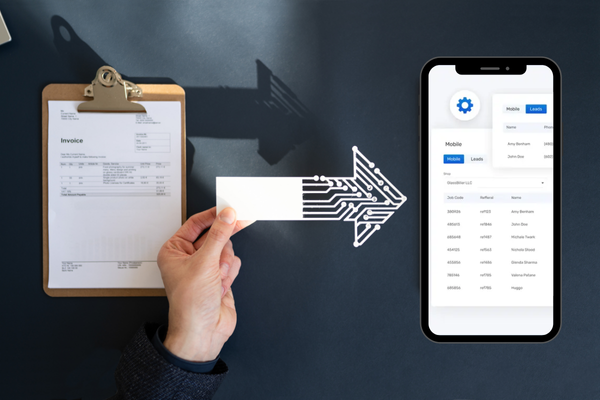

In the fast-paced world of auto glass repair and replacement, efficient billing processes are crucial to maintaining smooth operations and ensuring timely payments. However, many auto glass businesses struggle with managing their billing and invoicing, leading to issues like cash flow disruption and inefficiency. This article delves into common challenges faced by auto glass companies in their billing processes and explains how advanced solutions like GlassBiller can make a significant difference.

The Importance of Efficient Billing Software in the Auto Glass Industry

For auto glass businesses, handling numerous work orders, processing insurance claims, and managing customer payments can be complex. Without a proper billing system in place, these tasks can become overwhelming and error-prone. Implementing reliable auto glass invoicing software is essential for streamlining processes, reducing administrative burdens, and ensuring that all payments are tracked efficiently. This can save time and money, allowing businesses to focus on providing top-notch service to their clients.

Common Challenges in Autoglass Billing

Auto glass businesses often encounter several billing and invoicing challenges that can hinder their financial stability. Let’s explore these issues and their impact:

Tracking Unpaid Invoices

Unpaid invoices are a common headache for many businesses, and auto glass companies are no exception. These overdue payments can quickly pile up, creating cash flow problems that may affect day-to-day operations. Some of the challenges include:- Delayed Payments: Clients may delay payments for various reasons, from oversight to financial difficulties. Without a proper tracking system, businesses can lose sight of which invoices are outstanding.

- Impact on Cash Flow: When payments are delayed, it directly affects the cash flow of the business, making it difficult to cover expenses like payroll, rent, and inventory.

A lack of visibility into overdue invoices likely leads to mismanaged accounts and a lost opportunity to follow up with clients. Thus, the collection delays begin.

Processing Insurance Claims

Processing insurance claims is an essential part of the billing process in an auto glass company. However, it may be quite a headache, as one has to interact with different insurance providers, each of which may have strict rules and conditions. The following are contributing factors:- Varied Providers: Due to the diversity of insurance companies, each may have different requirements for documentation and the form of claim submission. As a result, it takes time for approval.

- Time-Consuming Nature of the Claims: People still have to submit the claims manually, which requires hours or even days of work.

The above-mentioned workflow bottlenecks mean that companies have to wait for payments for an excessively long time. Claim payment delays cause serious financial problems for auto glass companies.

Managing Work Orders

Managing work orders is another serious bottleneck. It is especially urgent when dealing with multiple customers and job sites, as is the case with auto glass companies. The following situations may occur in the absence of proper organization:- Chaotic management

- Manual errors

- Real-Time Alerts

One of the unique features of GlassBiller is the ability to provide daily, real-time alerts. Because GlassBiller is cloud-based, these alerts can cover a range of updates:

- Automatic Reminders: GlassBiller will automatically create reminders for clients and customers who have not yet paid for your services, so you won’t forget to chase them. This eliminates the need to remember which invoices are outstanding.

- Pending Tasks: GlassBiller will also notify you of any outstanding jobs or services yet to be invoiced. This allows your business to move faster, complete a job, and invoice for it promptly, instead of waiting and losing interest. You will also receive real-time updates on any insurance claims needing your input to proceed.

By notifying glass shops in real-time about insurance claims needing resubmission, as well as any jobs or invoices outstanding, the GlassBiller software improves cash flow and overall financial housekeeping for businesses.

Accounts Receivable Tracking

GlassBiller provides an easy-to-use and simple system for tracking accounts receivable. The benefits include:- The Comprehensive Dashboard: This central page offers a “one-screen” detailed view of every unpaid invoice. This helps auto glass companies keep a close eye on their cash flow.

- Customized Reports: GlassBiller allows businesses to download a range of reports for their accounts receivable. These reports can highlight a particular customer who frequently delays payments or provide a list of those who consistently do not pay on time. This feature can help improve long-term business operations.

This system helps auto glass companies save valuable time that would otherwise be spent chasing customers for outstanding bills. The time saved can be reinvested in marketing and providing better services.

Work Order Management Efficient work order management software is of great importance for auto glass businesses, which often have to deal with multiple jobs at once. GlassBiller’s work order management offers several key benefits:

- Digital Work Orders: Workers can easily create new orders and manage them within the software, eliminating the need for filling out or printing forms.

- Streamlined Scheduling: All jobs can be scheduled and assigned to technicians in a single location, allowing you to keep track of them and ensure no job is left incomplete or delayed.

GlassBiller provides a way for businesses to centralize the work order management process, improve accuracy, and reduce manual input and paperwork, ensuring better client service.

Conclusion

Overall, for auto glass businesses, eliminating billing and invoicing challenges and addressing the problem of insurance claim processing is crucial for maintaining a healthy cash flow and ensuring efficient operations. These challenges can be effectively addressed using GlassBiller’s capabilities, as this software allows auto glass businesses to automate their work and reduce the input for a more effective management process, as well as a better service provision.

The described capabilities of GlassBiller include real-time alerts, accounts receivable, insurance claims, and work order management features, which allow this software to successfully overcome the existing billing challenges. As a result, for auto glass businesses interested in automating most of their processes and ensuring better financial and work management, this is a solution worth considering.